PROJECT

For the European Green Deal to deliver on its renewables’ revolution, policymaking needs to focus on cleantech innovation and access to finance for the deployment of renewable energy (RE) from below.

Even if investing in fossil fuel assets is financially risky, regulatory barriers remain for RE investment to prove it will outperform, or it will be as profitable as, investments in fossil fuel–based sectors.

A knowledge gap has emerged on the bankability of storing renewable energy, where an energy justice and gender-responsive approach is long overdue. In the European Union, more than 50 million people are affected by energy poverty, with a disproportionate impact on women. Further, energy technology commercialization and access to finance are more difficult to achieve for women.

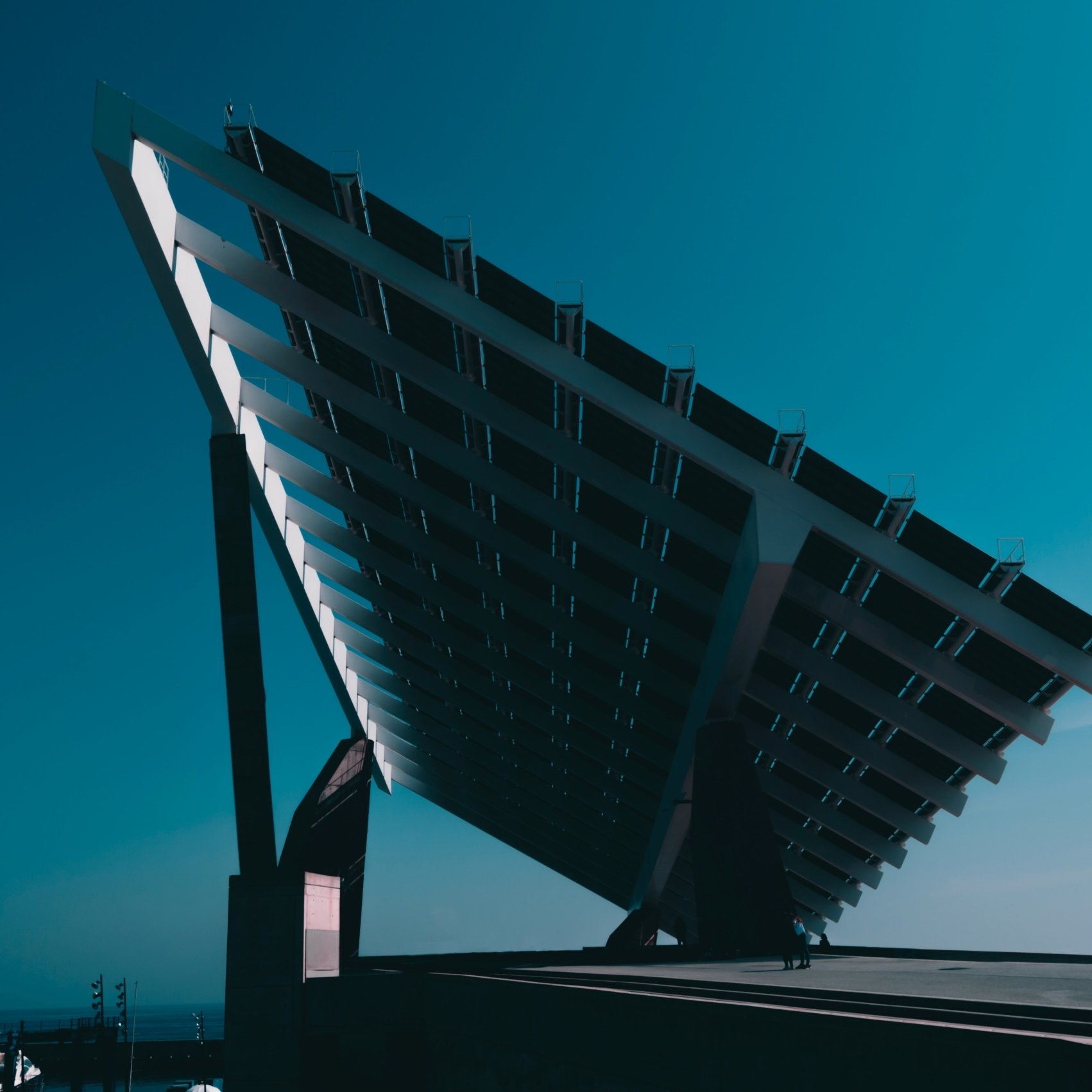

The ultimate objective of RE-DESIGN is to propose a gender-sensitive regulatory blueprint for how effective policy design for RE storage technologies can enable individuals and renewable energy communities to access finance for storing RE. Accordingly, the project aims to contribute to bolstering energy security, the achievement of sustainability commitments, as well as architectural innovations and enhanced competitiveness in electricity markets, starting from a shared and equitable vision for the European Union.

WHY RENEWABLE ENERGY STORAGE?

In the current wartime resurgence of fossil fuels, policymakers are focusing more on bringing down the price of oil and gas, rather than ensuring long-term energy security through renewable energy storage technology. Fossil fuels, and notably gas, is often coupled with renewable energy sources for the baseload supply of electricity. As the argument goes, renewable options are unsuitable for baseload supply due to their intermittent character. Being intermittent, renewable energy lacks continuous availability for conversion into electricity. Moreover, loads from renewable energy production must at times be reduced. The normative claim of this project is that the solution to both challenges lies not in fossil fuels, but in storing renewable energy.

Today’s geopolitical setting can thus help identify three specific impacts of energy storage: to enhance the EU’s energy security, to allow for a more decentralized and participatory energy system, and to lower prices for consumers, contributing to a better internal market.

EVENTS

➽ 6 Oct 2022: 2022 Oslo International Environmental Law Conference (IUCN-WCEL) | “Riders on the Storm: Decarbonising Fiduciary Duties in Climate Matters”

➽ 26 Sept 2022: Internal Presentation at ECIP, CMCC | “Why Energy Storage”

➽ 3 May 2023: Moderator at World Hydrogen & Renewables Italy 2023 | Panel: The Role of Battery Storage as a Crucial Piece of the Puzzle (May 2023, Plenary session)

➽ 5 May 2023: Organizer | EU Energy Day at Istituto Cattaneo, Milan (Climate Negotiations Simulation, Climate Interactive, En-ROADS, MIT)

OUTPUTS

➽ https://www.cmcc.it/people/colombo-esmeralda

➽ www.esmeraldacolombo.com

➽ https://www.researchgate.net/profile/Esmeralda-Colombo-2

➽ Esmeralda Colombo:

Pension funds, sustainable finance and divestment.

Hearing with research group of Transition écologique du droit économique (TEDE), a collaborative research project funded by the French environmental protection agency and the French Ministry of Justice [01/12/2022]

➽ A blog post [20/01/2023]:

https://energypost.eu/europe-

➽ A policy brief [20/01/2023]:

https://www.climateforesight.

➽ Esmeralda Colombo, “Unpacking Corporate Due Diligence in Transnational Climate Litigation” (2022) 1 Ex Ante 35;

➽ Esmeralda Colombo, “The Politics of Silence: Future Generations’ Fight for Climate in Hannah Arendt’s Thought” (2023) The Vienna Journal on International Constitutional Lawhttps://doi.org/10.1515/icl-2022-0017 (Special Issue on Social Contract Theory in the Age of Climate Crisis);

➽ Interview on the rise of climate lawyers, https://changes.unipol.it/environment/perche-i-climate-lawyers-crescono (January 2023)

Marie Sklodowska-Curie Fellow

Supervisor

Co-Supervisor

Project Manager

“This project has received funding from the European Union’s Horizon 2020 research and innovation programme under the Marie Sklodowska-Curie grant agreement No 101028505”.